Exchange Rate and Gold Price: Evidence from Malaysia

DOI:

https://doi.org/10.51200/lbibf.v12i.348Keywords:

Exchange rate, gold price, cointegrationAbstract

This study examines the relationship of exchange rate and gold price in Malaysia. The autoregressive distributed lag (ARDL) approach shows that there is long-run relationship between exchange rate and its determinants, includes gold price. An increase in gold price will lead to a depreciation of the US dollar. There is a negative relationship between exchange rate and gold price. Gold price is found to have a significant impact on exchange rate in the short run. The generalized forecast error variance decompositions demonstrate that changes of gold price influence the forecast error variance of changes of exchange rate. There is a link between the gold market and the exchange rate market.

Downloads

Published

How to Cite

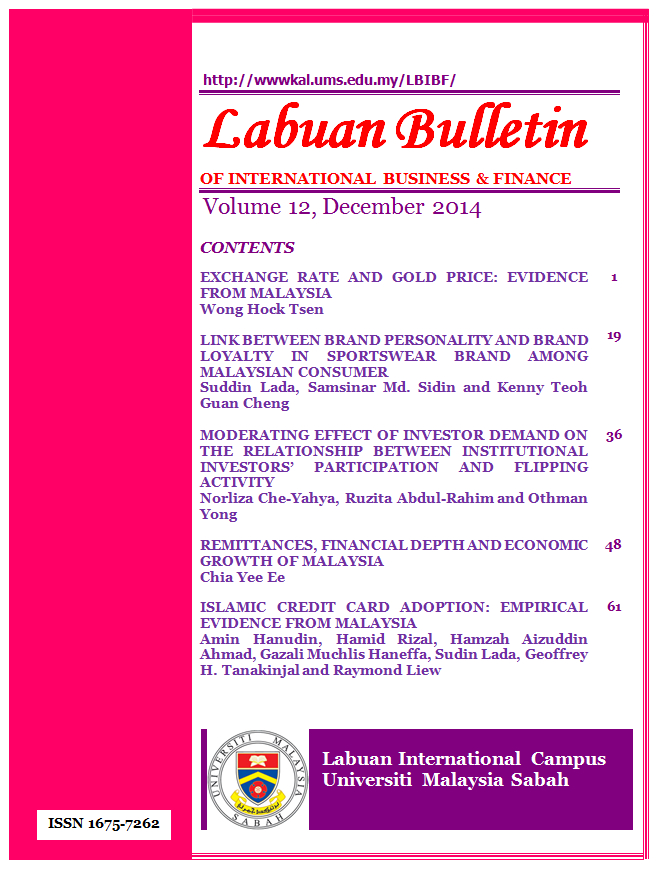

Issue

Section

License

Copyright (c) 2016 Labuan Bulletin of International Business and Finance (LBIBF)

This work is licensed under a Creative Commons Attribution 4.0 International License.