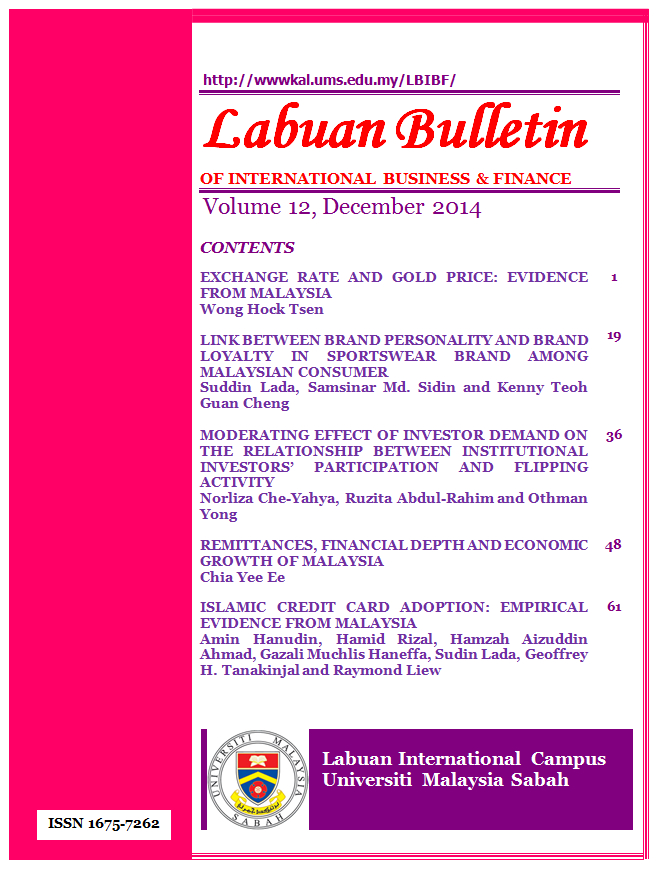

Islamic Credit Card Adoption: Empirical Evidence From Malaysia

DOI:

https://doi.org/10.51200/lbibf.v12i.352Keywords:

Islamic credit card, TRA, bank, MalaysiaAbstract

The aim of this study is to investigate the factors determining the Malaysian bank customer's behavioral intention to use Islamic credit card. Drawing from the Theory of Reasoned Action (TRA), this study proposes a modified and simplified model to examine the acceptance factors of attitude, subjective norm and perceived financial cost within the Islamic credit card context. The model is tested using survey data from 257 respondents. The results reveal that attitude, subjective norm and perceived financial cost significantly influence the Islamic credit card intention to use. The study is an eye opener on the need to establish the link between TRA and Islamic credit card behavioral intention, which previously is limited to investigate.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2016 Labuan Bulletin of International Business and Finance (LBIBF)

This work is licensed under a Creative Commons Attribution 4.0 International License.