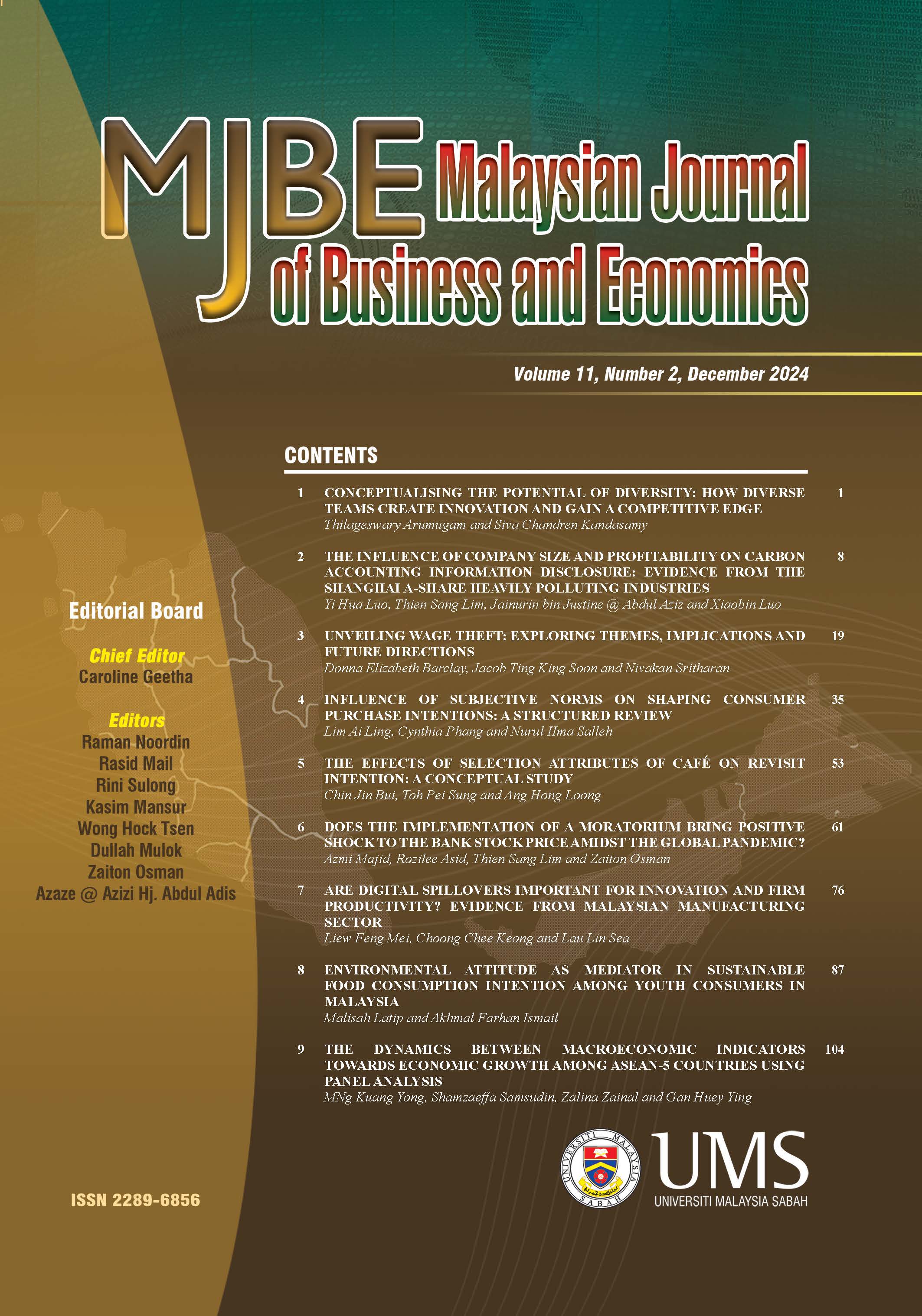

THE DYNAMICS BETWEEN MACROECONOMIC INDICATORS TOWARDS ECONOMIC GROWTH AMONG ASEAN-5 COUNTRIES USING PANEL ANALYSIS

DOI:

https://doi.org/10.51200/mjbe.v11i2.5806Keywords:

Economic growth, inflation, trade openness, ASEAN-5, panel, macroeconomic indicatorsAbstract

This study aims to identify the most appropriate model for conducting panel data analysis on the macroeconomic indicators towards the economic growth in ASEAN-5 countries. The research focuses on five countries: Malaysia, Singapore, Thailand, Philippines, and Indonesia, covering the period from 1980 to 2019. The independent variables under investigation include inflation, percentage of money supply to GDP, trade openness, and population. Three models are utilized including the common constant model, fixed effect model, and random effects model. To determine the most suitable model, the researchers employ the Redundant fixed effects test and the Hausman test for specification testing. The fixed effect model emerges as the most adequate model. The significant P-values obtained from both tests provide evidence in favor of the fixed effect model, indicating that it is the most appropriate choice for understanding the relationships between the independent variables and economic growth in the ASEAN-5 countries. The findings of the fixed effect model show that inflation and money supply are negatively and significantly related to economic growth at the 1% level. Trade openness is positively related to economic growth, but not significantly. Additionally, the population has a significantly positive relationship with economic growth.

References

Chaitip, P., Chokethaworn, K., Chaiboonsri, C., & Khounkhalax, M. (2015). Money Supply Influencing on Economic Growth-wide Phenomena of AEC Open Region. Procedia Economics and Finance, 24(July), 108–115. Retrieved from https://doi.org/10.1016/s2212-5671(15)00626-7.

Dritsakis, N., Varelas, E., & Adamopoulos, A. (2006). The main determinants of economic growth: An empirical investigation with Granger causality analysis for Greece. European Research Studies 9(3), 1–22. Retrieved from http://www.ersj.eu/repec/ers/papers/06_34_p4.pdf.

García, M.J.O., & Viet, L.T. (2021). The Impact of Money Supply on the Economy: A Panel Study on Selected Countries. Journal of Economic Science Research, 4(4), 48–53. Retrieved form https://doi.org/10.30564/jesr.v4i4.3782.

Gujarati, D.N. & Porter, D.C. (2009). Basic Econometrics, 5th ed. New York: McGraw Hill Inc.

Hoang, T.N. (2021). Relationship between inflation and economic growth in Vietnam. Turkish Journal of Computer and Mathematics Education, 12(14), 5134–5139.

Ioan, B., Malar K.R., Larissa, B., Anca, N., Lucian, G., Gheorghe, F., Horia, T., Ioan, B., & Mircea-Iosif, R. (2020). A Panel Data Analysis on Sustainable Economic Growth in India, Brazil, and Romania. Journal of Risk and Financial Management, 13(8), 1-19. Retrieved from https://doi.org/10.3390/jrfm13080170.

Mohamed, A.A., & Hisham, H.A. (2015). Determinants of Economic Growth in GCC Economies. Asian Journal of Research in Business Economics and Management, 5(1), 18–23.

Mohammed, E.H., & Mahfuzul, H. (2017). Empirical Analysis of the Relationship between Money Supply and Per Capita GDP Growth Rate in Bangladesh. Journal of Advances in Economics and Finance, 2(1), 54–66. Retrieved from https://doi.org/10.22606/jaef.2017.21005.

Nasreen, S., & Anwar, S. (2014). Causal relationship between trade openness, economic growth and energy consumption: A panel data analysis of Asian countries. Energy Policy, 69(1), 82–91. Retrieved from https://doi.org/10.1016/j.enpol.2014.02.009.

OECD. (2023). List of developed and developing countries 2018. Retrieved from https://www.oecd-ilibrary.org/sites/f0773d55-en/1/4/3/index.html?itemId=/content/publication/f0773d55-en&_csp_=5026909c969925715cde6ea16f4854ee&itemIGO=oecd&itemContentType=book.

Peter, A., & Bakari, I. H. (2018). Impact of Population Growth on Economic Growth in Africa: A Dynamic Panel Data Approach (1980 -2015). Pakistan Journal of Humanities and Social Sciences, 6(4), 412–427. Retrieved from https://doi.org/10.52131/pjhss.2018.0604.0055.

Próchniak, M. (2011). Determinants of economic growth in Central and Eastern Europe: The global crisis perspective. Post-Communist Economies, 23(4), 449–468. Retrieved from https://doi.org/10.1080/14631377.2011.622566.

Rahman, M. M., Saidi, K., & Ben, M.M. (2017). The effects of population growth, environmental quality and trade openness on economic growth: A panel data application. Journal of Economic Studies, 44(3), 456–474. Retrieved from https://doi.org/10.1108/JES-02-2016-0031.

Thaddeus, K. J., Ngong, C. A., Nebong, N. M., Akume, A. D., Eleazar, J. U., & Onwumere, J. U. J. (2021). Selected macroeconomic determinants and economic growth in Cameroon (1970–2018) “dead or alive” an ARDL approach. Journal of Business and Socio-Economic Development. https://doi.org/10.1108/jbsed-05-2021-0061.

Ulaşan, B. (2015). Trade openness and economic growth: panel evidence. Applied Economics Letters, 22(2), 163–167. Retrieved from https://doi.org/10.1080/13504851.2014.931914.

World Bank. (2023). GNI per capita. Retrieved from https://data.worldbank.org/indicator/NY.GNP.PCAP.CD.

World Bank. (2023). New country classifications by income level: 2019-2020. Retrieved from https://blogs.worldbank.org/opendata/new-world-bank-country-classifications-income-level-2022-2023.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Malaysian Journal of Business and Economics (MJBE)

This work is licensed under a Creative Commons Attribution 4.0 International License.

CCBY (Attribution)

https://creativecommons.org/licenses/by/4.0/

© Universiti Malaysia Sabah 2025

All rights reserved. No part of this publication may be reproduced, distributed, stored in a database or retrieval system, or transmitted, in any form or by any means, electronic, mechanical, graphic, recording or otherwise, without the prior written permission of Universiti Malaysia Sabah Press, except as permitted by Act 332, Malaysian Copyright Act of 1987. Permission of rights is subjected to the journal.