SUBSTITUTION EFFECTS: DO INFLATION AND DEFLATION AFFECT ISLAMIC HOME FINANCING?

DOI:

https://doi.org/10.51200/ljms.vi.2995Keywords:

Malaysia, Islamic home financing, profit rate, flat rateAbstract

This paper considers the substitution effects on Islamic home financing in Malaysian Islamic banks. The Islamic principle that supports Islamic financing is Bay Bithaman Ajil (BBA). Many debates were made on the validity of BBA, however in Malaysia it is widely employed as one of the financing schemes available. Even conventional banks with Islamic window such as Maybank, HSBC, Public Bank to name a few are among those banks that are currently providing Islamic home financing. Although differences do exist with respect to the policy, such as those that relate to the pricing of the schemes. Supporting documents and related costs associated with Islamic home financing. Overall,

Islamic home financing is Shariah-compliant and thus should be seen as an alternative for Muslims financing instead of problem. In the full-fledged Islamic banks, Islamic home financing is seen more apparent to become one of the sources of profit to the banks. Finally, the authors suggest an explanation based on the theory of substitution effect to explain the choice between Islamic home financing and conventional home loan. It is hoped that the paper will benefit academicians as well as practitioners.

Downloads

Published

How to Cite

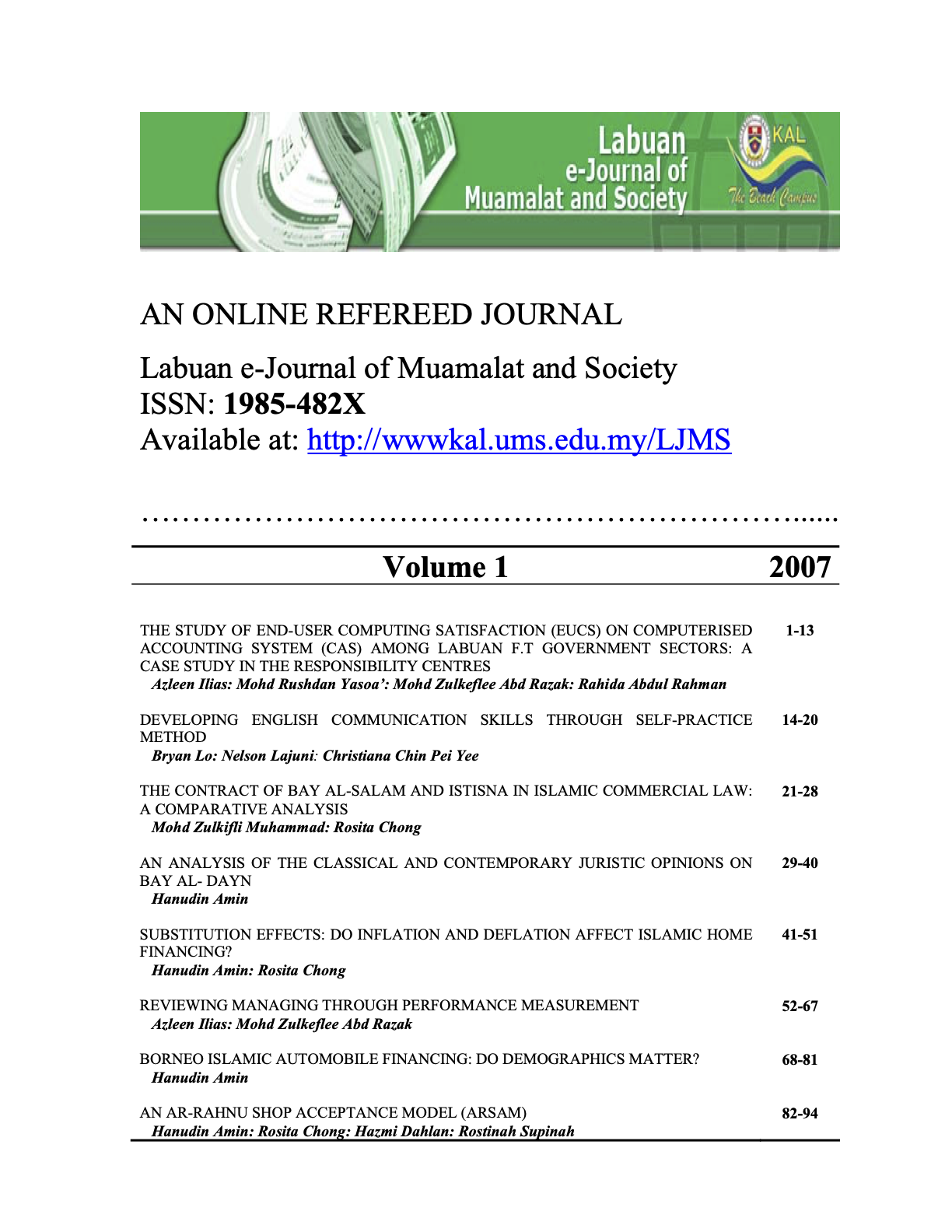

Issue

Section

License

Copyright (c) 2007 Labuan e-Journal of Muamalat and Society (LJMS)

This work is licensed under a Creative Commons Attribution 4.0 International License.