BORNEO ISLAMIC AUTOMOBILE FINANCING: DO DEMOGRAPHICS MATTER?

DOI:

https://doi.org/10.51200/ljms.vi.2997Keywords:

Malaysia, bank customers, Borneo, automobile financingAbstract

As far as an Islamic automobile financing is concerned, this study aims at investigating the customers’ perception on Islamic automobile financing based on individual differences. Interestingly, the study will employ the Malaysia Borneo’s bank customers as a sample, where two cities were selected, Kota Kinabalu and Labuan. In order to examine the customers’ perception, the study uses a quantitative approach to survey 128 Malaysia Borneo’s bank customers. Based on the survey, a theoretical framework that explains the

relationship between demographics and bank customers “awareness and usage”, “banking methods option” as well as “information medium” could be presented. The findings indicate that there were significant differences between the selected

demographics (i.e. age, marital status, gender, occupation, race, education and income level) and “awareness and usage” of Islamic automobile financing, “banking methods option” and “information medium”. This study suffers from the limited literature review relevant to Islamic automobile financing. Therefore, this study will add to the limited knowledge available on Islamic automobile financing in Malaysia. Future research could benefit from this study results. This study provides guidelines to commercial banks on Islamic automobile financing offerings. This study is also useful for banks in structuring their Islamic automobile financing scheme by adjusting the mark-up, types of payment and gifts to reflect individual differences. It also suggests a new study related to Islamic automobile financing, which is limited in the previous studies.

Downloads

Published

How to Cite

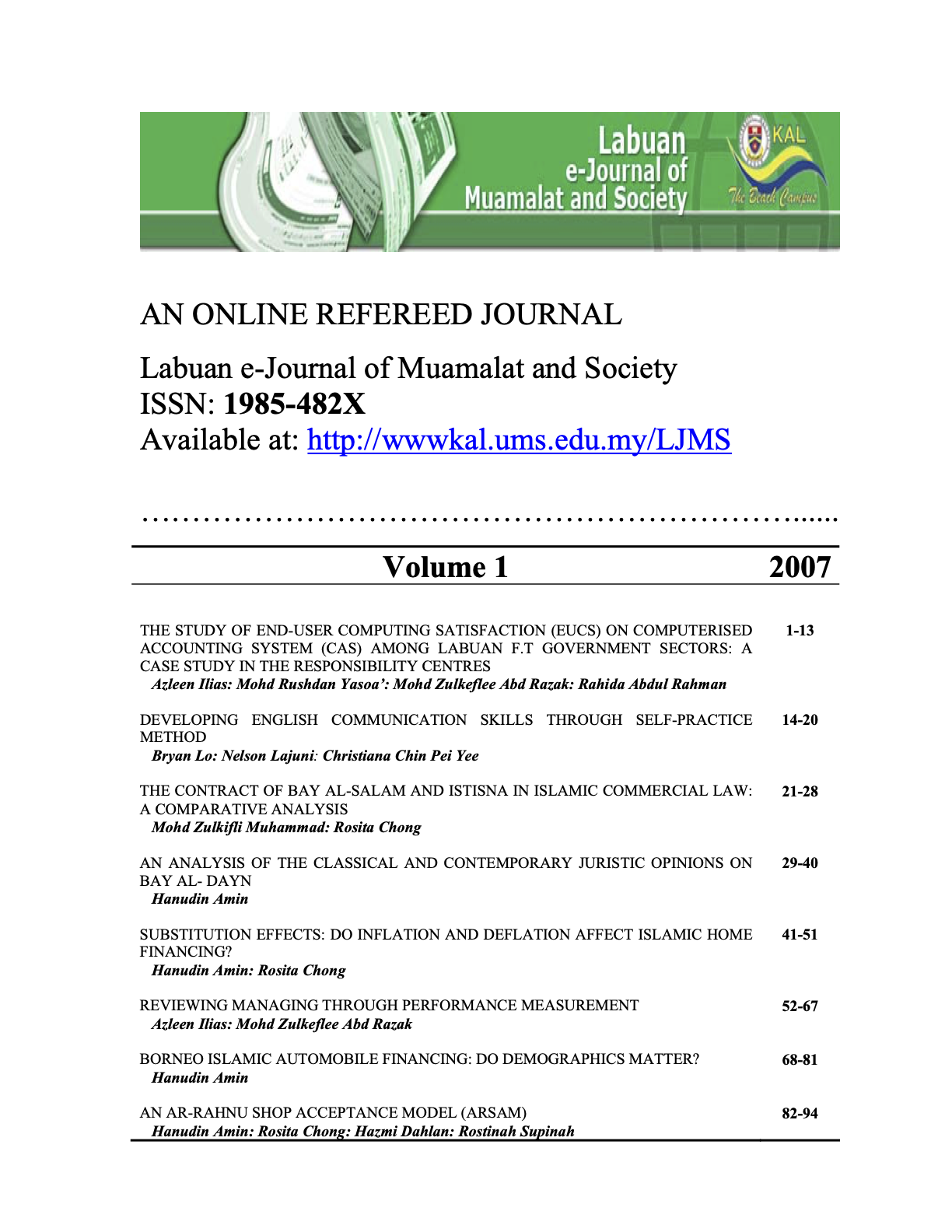

Issue

Section

License

Copyright (c) 2007 Labuan e-Journal of Muamalat and Society (LJMS)

This work is licensed under a Creative Commons Attribution 4.0 International License.