THE ISLAMIC HOME FINANCING IN MALAYSIA ISTISNA’ BASE ON DEBT: QUALITATIVE APPROACH

DOI:

https://doi.org/10.51200/ljms.v8i.3016Keywords:

Islamic home financing, Al-Istisna’, Debt financingAbstract

Malaysia’s Islamic Finance industry had existed for more than thirty (30) years, continues to grow rapidly supported by conducive environment, comprehensive financial structure, and adopted global regulatory and legal best practices. Today, the Islamic finance industry is considered to be a dynamic industry, which is a competitive alternative to conventional financing. This paper attempts to provide an explanation of the method of Islamic home financing in Malaysia, focus on the Shariah compliant modes on home ownership that are currently exist al-istisna’. These contract is defined as a contract to purchase now and for a definite price. Houses that may be manufactured or constructed later, according to agreed specifications. The house under istisna’ is often not available now. However, will be made later by the contractor. Therefore, the focus to enhance al-istisna’ contract theories into application especially for the housing industry. Istisna’ is rightest comparatively to Bai Bithamin Ajil (bba) and Musyarakah Mutanaqisah (mm). The contract does not given the opportunity in the practice. Problems arise such as incomplete housing issues are able to solve by furthering the application of Istisna’. This study uses a qualitative approach. Currently, in Malaysia the Islamic Banks are exercising the most famous form of house financing bba home financing. Bba has started implementing since 1993.While others practice mm. This concept of home financing has been implemented since 2000. Hence this study analyses Istisna’ as an alternative contract. Thus, Istisna’ is an alternative for Islamic home financing.

Downloads

Published

How to Cite

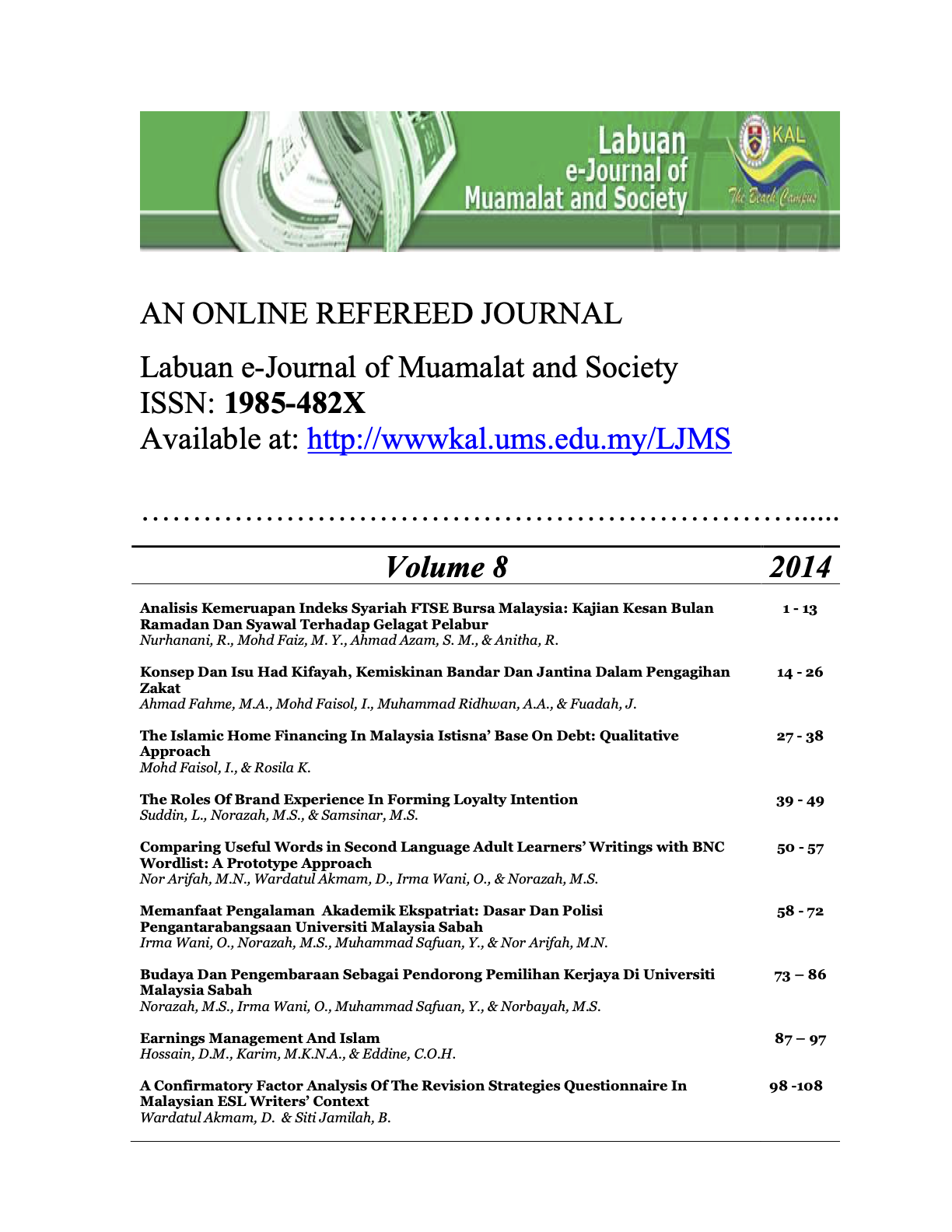

Issue

Section

License

Copyright (c) 2014 Labuan e-Journal of Muamalat and Society (LJMS)

This work is licensed under a Creative Commons Attribution 4.0 International License.