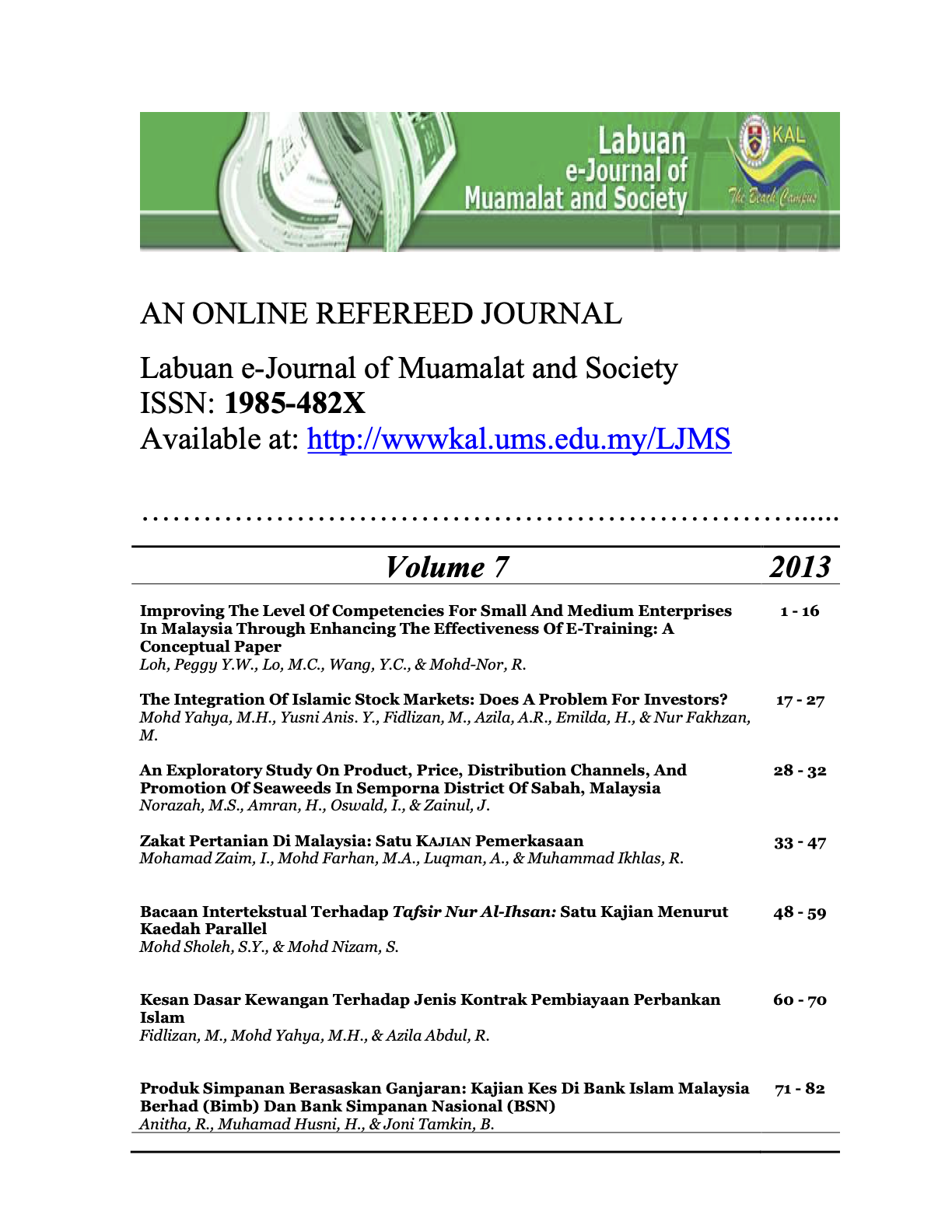

THE INTEGRATION OF ISLAMIC STOCK MARKETS: DOES A PROBLEM FOR INVESTORS?

DOI:

https://doi.org/10.51200/ljms.v7i.3008Keywords:

Islamic Stock Market, Investment Portfolios, Co-integration, Granger Causality, Variance DecompositionAbstract

This paper empirically investigates co-integration between Islamic stock market in Malaysia, Indonesia and the world by applying the Vector Auto Regression (VAR) method. This research used monthly data from January 2007 to May 2012 taken from authorized sources. The finding shows that there is no long-run or equilibrium relationship exists between FTSE Bursa Malaysia Emas Shariah (FBMES), Jakarta Islamic Index (JAKISL), and Dow Jones Islamic Market index (DJIM). Based on the result, hence, it can be concluded that the Islamic stock markets of Malaysia does not integrate with Indonesia’s, as well as with the world markets in the long run. This will create rooms for investors to diversify their investment portfolios, which puts Malaysia as one of their favoured investment destinations. From the Granger causality view, the return of JAKISL and DJIM is driven by the return of FBMES in the short run.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2013 Labuan e-Journal of Muamalat and Society (LJMS)

This work is licensed under a Creative Commons Attribution 4.0 International License.