ANALISIS KEMERUAPAN INDEKS SYARIAH FTSE BURSA MALAYSIA: KAJIAN KESAN BULAN RAMADAN DAN SYAWAL TERHADAP GELAGAT PELABUR

DOI:

https://doi.org/10.51200/ljms.v8i.3014Keywords:

Stock Volatility, FestivalsAbstract

Islamic stock market is a market that is free from any element that is forbidden by Allah SWT. Shall be the duty of Muslims to prevent investors from engaging in any investment which is prohibited in Islam. In the month of Ramadan all Muslims fast for hunger and thirst. during the month of Ramadan, people will be trained to control the desires and forms a noble character. A noble personality is important for people to control the desires of any act done on this earth. This study will examine the behavior of investors in the stock market during the Muslim month of Ramadan and Syawal of the year 2007-2010. This study will use daily data for the index and selected macroeconomic factors starting in 2007-2010. Based on these studies later, the volatility of the stock index will be compared for 3 years starting from the mutual cooperation between Bursa Malaysia and FTSE. The study also will look at the effect of speculation on the stock index, such as Islam as well known, speculation is an activity that is prohibited in Islam because this will lead to the problem of price volatility in the stock market and thus affect the real objective of shares traded. By increasing the rituals performed during the month, is expected to affect the way investors invest.

Downloads

Published

How to Cite

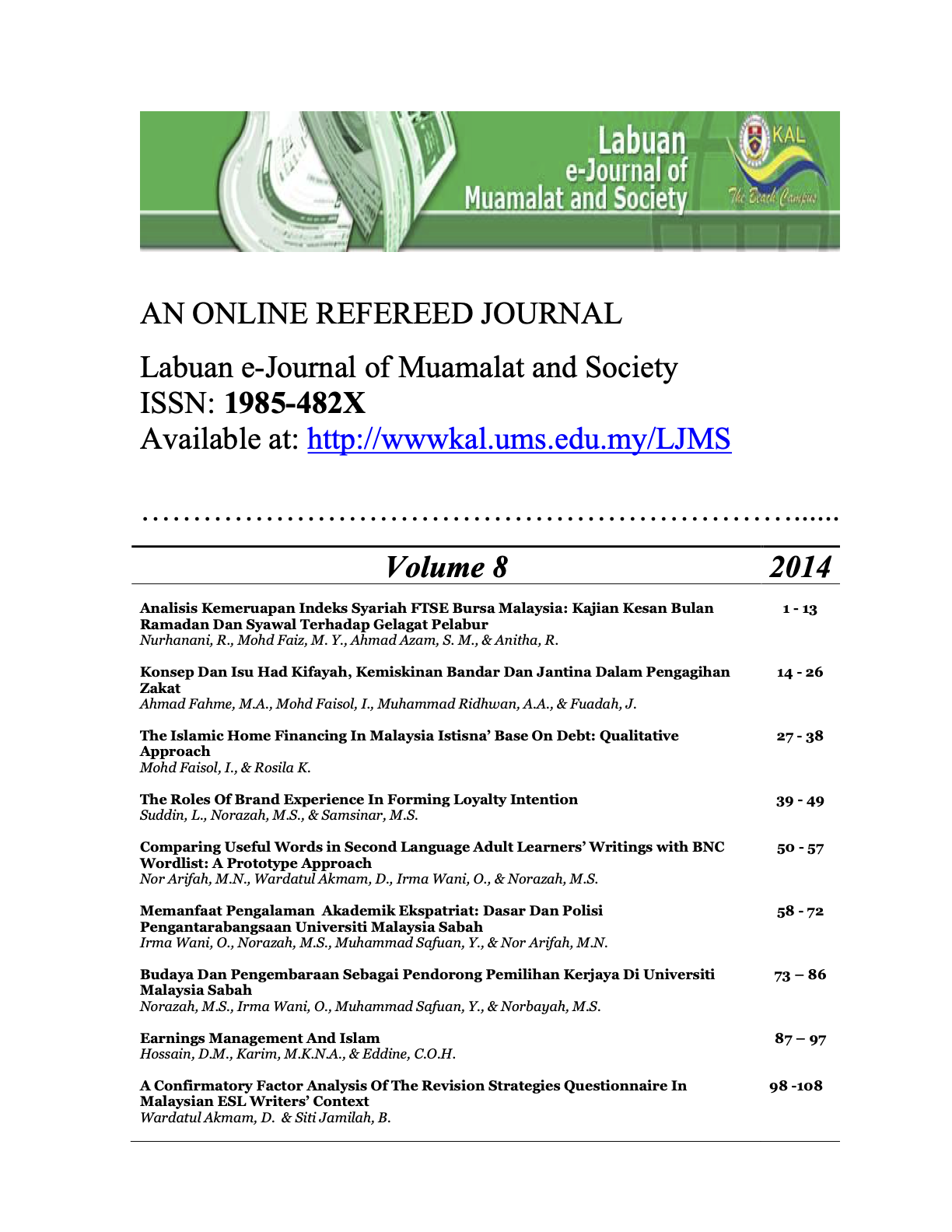

Issue

Section

License

Copyright (c) 2014 Labuan e-Journal of Muamalat and Society (LJMS)

This work is licensed under a Creative Commons Attribution 4.0 International License.